How do I mail a credit bureau?

Summary

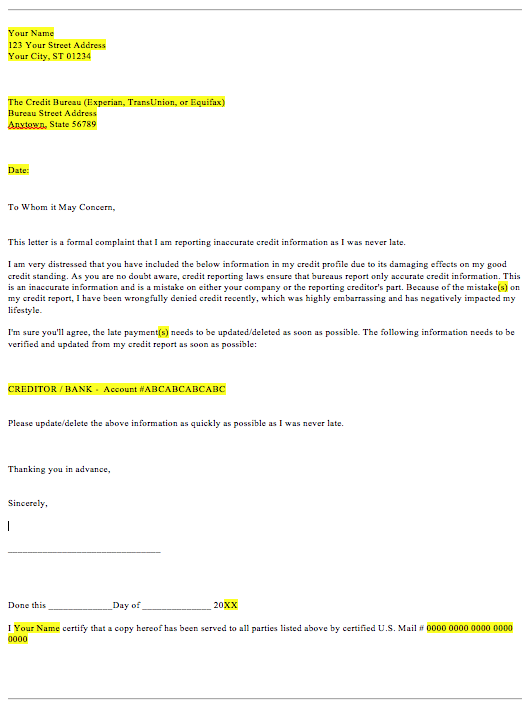

Mailing a dispute letter to credit bureaus is a common way to resolve issues on your credit report. This article provides information on how to address an envelope, the mailing addresses for Equifax, Experian, and TransUnion, as well as the benefits of sending your letter by certified mail.

Questions and Answers

1. What is the mail address for credit bureaus?

The mailing address for Equifax is P.O. Box 740241, Atlanta, GA 30374-0241. The address for Experian is P.O. Box 2104, Allen, TX 75013-0949. The address for TransUnion is P.O. Box 1000, Chester, PA 19022.

2. How do you address an envelope to a credit bureau?

To address an envelope to a credit bureau, include the date, the credit bureau’s full mailing address, your information (including full name, address, date of birth, and relevant account name/credit report number), and the name of the creditor or collection agency that made the error.

3. How do I send something to the credit bureau?

It is recommended to send your letter by certified mail with “return receipt requested” to document that the credit bureaus received it. Remember to keep your original documents and include copies of the documents that support your request.

4. What is the mailing address for Equifax?

The mailing address for Equifax is Equifax Disclosure Department, P.O. Box 740241, Atlanta, GA 30374.

5. Can you write a letter to credit bureau?

Yes, you can write a letter to a credit bureau to dispute an issue on your credit report. Make sure to detail the error(s) you found and include copies of important documents to aid the investigation.

6. How do I contact all 3 credit bureaus?

You can contact Equifax at 1-800-685-1111 or visit their website Equifax.com/personal/credit-report-services. For Experian, call 1-888-397-3742 or go to Experian.com/help. To reach TransUnion, dial 1-888-909-8872 or visit TransUnion.com/credit-help.

7. Does sending letters to credit bureaus work?

Sending a credit dispute letter does not guarantee that the credit reporting agency will remove an item. However, providing strong documentation greatly increases the chances of a successful dispute. It is a low-cost method that is worth trying.

8. Does writing letters to credit bureaus work?

Writing a letter to a credit bureau is one of the ways to dispute an issue on your credit report. Include details about the error(s) you found and provide copies of supporting documents for a more effective investigation.

9. Can you handwrite letters to credit bureaus?

While it was common in the past to handwrite credit dispute letters, it is now more common to type and mail them or submit the information online through the credit bureaus’ submission forms.

10. Where do I mail my TransUnion credit dispute?

To dispute your TransUnion report by mail, send your dispute letter to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000. Include your Social Security number and date of birth in the letter.

What is the mail address for credit bureaus

The mailing address for Equifax is P.O. Box 740241, Atlanta, GA 30374-0241. The address for Experian is P.O. Box 2104, Allen, TX 75013-0949. The address for TransUnion is P.O. Box 1000, Chester, PA 19022.

Cached

How do you address an envelope to a credit bureau

What should I put in my dispute letterThe date you will mail the letter.The credit bureau's full mailing address.Your information, including full name and address, date of birth, and the relevant account name and/or credit report number.The name of the creditor or collection agency that made the error.

Cached

How do I send something to the credit bureau

Send your letter by certified mail with “return receipt requested,” so you can document that the credit bureaus got it. Keep your original documents. Include copies of the documents that support your request and save copies for your files.

Cached

What is the mailing address for Equifax

On our automated phone line: (800) 685-1111. Hours are 7:30 a.m. — 1:30 a.m. ET. By mail to: Equifax Disclosure Department, P.O. Box 740241, Atlanta, GA 30374.

Can you write a letter to credit bureau

There are a few ways to dispute an issue on your credit report, including mailing a letter to the credit bureaus. Your credit dispute letter should detail the error (or errors) you found on your credit report. Your letter should also include copies of important documents to help the bureaus conduct an investigation.

How do I contact all 3 credit bureaus

Equifax: 1-800-685-1111; Equifax.com/personal/credit-report-services. Experian: 1-888-397-3742; Experian.com/help. TransUnion: 1-888-909-8872; TransUnion.com/credit-help.

Does sending letters to credit bureaus work

A credit dispute letter doesn't automatically fix this issue or repair your credit. And there are no guarantees the credit reporting agency will remove an item—especially if you don't have strong documentation that it's an error. But writing a credit dispute letter costs little more than a bit of time.

Does writing letters to credit bureaus work

There are a few ways to dispute an issue on your credit report, including mailing a letter to the credit bureaus. Your credit dispute letter should detail the error (or errors) you found on your credit report. Your letter should also include copies of important documents to help the bureaus conduct an investigation.

Can you hand write letters to credit bureaus

Traditionally, consumers would send handwritten credit dispute letters to the credit bureaus. However, these days, it's much more common to send a typed version through the mail or even to simply submit the information directly to the credit bureaus themselves through an online submission form.

Where do I mail my TransUnion credit dispute

How to dispute your TransUnion report by mail. You can send disputes by mail to TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000. TransUnion recommends including the following in your dispute letter: Your Social Security number and date of birth.

Can you send certified mail to Equifax

Whenever you communicate with a debt collector, credit reporting agency (Equifax, Experian, Trans Union, etc), or your mortgage company, we always recommend that you do so by certified mail, return receipt requested.

What is the 609 loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

How do I issue a letter of credit

Basic letter of credit procedurePurchase and sales agreement. The buyer and the seller draw up a purchase and sales agreement.Buyer applies for letter of credit.Issue letter of credit.Advise letter of credit.Prepare shipment.Present documents.Payment.Document transfer.

Do I need to contact all 3 credit bureaus

just one. In most cases, you will need to contact all three credit bureaus separately if you have an error to dispute or want to freeze (or unfreeze) your credit. There is only one exception: fraud. If you call one of the credit bureaus to ask for a fraud alert, that bureau will report it to the other two bureaus.

How long does it take to mail credit report

within 15 days

Phone: If you order your report by calling (877) 322-8228, your report will be processed and mailed to you within 15 days. Mail: If you use the Annual Credit Report Request Form or write a letter, your request will be processed and mailed to you within 15 days of receipt. Please allow two to three weeks for delivery.

How do you send a letter of credit

How to Apply for a Letter of CreditThe importer's bank credit must satisfy the exporter and their bank.Using the sales agreement's terms and conditions, the importer's bank drafts the letter of credit; this letter is sent to the exporter's bank.The exporter ships the goods as the letter of credit describes.

How long does it take for credit bureau to respond to letter

In most cases, the credit bureau has 30 days from the date of filing to investigate your claim, though an investigation can take up to 45 days in some circumstances. Once the investigation is complete, the bureau has five days to notify you of the results.

How do I write a letter to creditors to remove late payments

Based on my otherwise spotless payment history, I would like to request that you apply a goodwill adjustment to remove the late payment mark from my credit report. Granting this request will help me improve my overall credit history and demonstrate my consistency as a creditworthy borrower.

How do I dispute a credit report by mail

If you mail a dispute, your dispute letter should include:Contact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.

What is the mailing address for the 3 credit bureaus for disputes

Credit Bureau Mailing Addresses

| Credit Bureau | Mailing Address |

|---|---|

| Experian | P.O. Box 4500, Allen, TX 75013 |

| Equifax | P.O. Box 740256, Atlanta, GA 30374-0256 |

| TransUnion | P.O. Box 2000, Chester, PA 19016-2000 |

Mar 18, 2023

What is the best way to send certified mail

How to send Certified Mail. You need to go to a post office in person to send USPS Certified Mail®. At a post office or other mailing center, you can pick up copies of Form 3800 and attach them to your certified parcels yourself. You may also be able to print out certified mail labels online.

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

What is the 11 word phrase to stop debt collectors

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase “please cease and desist all calls and contact with me immediately” to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

How much does it cost to issue a letter of credit

A buyer will typically pay anywhere between 0.75% and 1.5% of the transaction's value, depending on the locations of the issuing banks. Sellers may find that their fees are structured slightly differently. Instead, they may pay a set of small flat fees that vary in cost.

What documents are required for letter of credit

Commercial Invoice (Proof of Value) Bill of Lading (Proof of Shipment) Packing List (Proof of Packing) Certificate of Origin (Proof of Origin)

0 Comments