Does Canada have Credit Karma?

Summary:

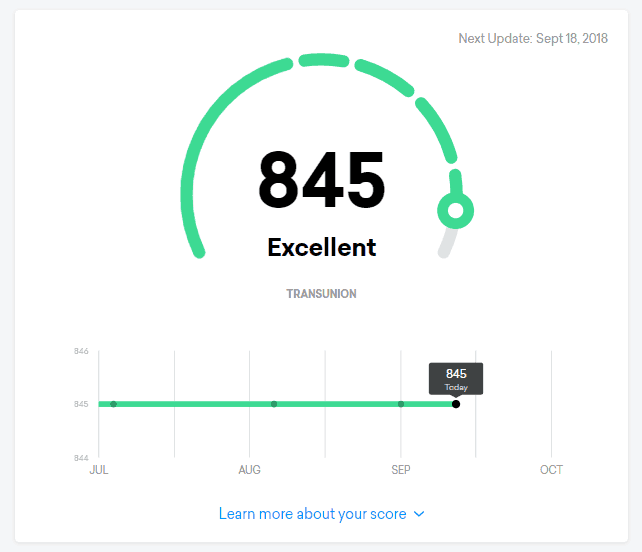

How accurate is Credit Karma Canada? Credit Karma provides accurate credit score and report information, as it is reported by two of the three credit agencies, Equifax and TransUnion. They also offer VantageScores, which are separate from the other two credit bureaus. Credit Karma is available in the United States, Canada, and the United Kingdom, providing free credit scores, credit reports, and daily credit monitoring from TransUnion. In Canada, you can access your credit score online from the two main credit bureaus, Equifax and TransUnion, and a good credit score is typically between 660 to 724. Your U.S. credit score is not valid in Canada, as each country has its own unique credit reporting system. The credit scores in Canada range from 300 to 900, while in America, they range from 300 to 850. You can use your Credit Karma Visa Debit Card anywhere in the world where Visa is accepted. In Canada, the FICO score, previously known as the Beacon score, is used by most lenders. It is not easy to achieve an 800 credit score in Canada, but with a high credit score, you can get approved for lower interest credit cards, better rewards, and loans such as mortgages and car loans.

Questions:

- How accurate is Credit Karma Canada?

The credit score and report information on Credit Karma Canada is accurate, as it is reported by Equifax and TransUnion, two of the three major credit agencies. They also provide separate VantageScores. - Which country uses Credit Karma?

Credit Karma is available in the United States, Canada, and the United Kingdom, providing free credit scores and reports from national credit bureaus TransUnion and Equifax. - How do I get my FICO score in Canada?

You can access your credit score online from Canada’s two main credit bureaus, Equifax and TransUnion. Your Equifax credit score is accessible online for free and is updated monthly. If you live in Quebec, you can also access your TransUnion credit score online for free. - What is similar to Credit Karma Canada?

Borrowell, Mogo, and Credit Karma are free credit score sites in Canada that provide access to credit scores and reports at no charge. These services also offer other financial products such as personal loans, credit cards, credit monitoring, identity protection, mortgages, and more. - What is considered a good credit score in Canada?

In Canada, a credit score between 660 to 724 is considered good. A score between 725 to 759 is likely to be considered very good, while a score of 760 and above is generally considered excellent. The credit score range in Canada is from 300 to 900. - Is my U.S. credit score valid in Canada?

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information is not shared across borders. - Are credit scores the same in the U.S. and Canada?

Credit scores in Canada range from 300 to 900, while in the United States, they usually range from 300 to 850. Although they function in a similar way, aiming for a high score, the scoring ranges differ. - Can I use my Credit Karma anywhere?

You can use your Credit Karma Visa Debit Card anywhere in the world where Visa is accepted. If you are unable to complete a transaction using your PIN, you can ask the merchant to process your payment as a Visa card. - What is FICO called in Canada?

In Canada, the credit score that most lenders use is called a FICO score, previously known as the Beacon score. It is a “hard” credit check. - How hard is it to get an 800 credit score in Canada?

Statistics show that approximately 17% of Canadians have an 800 credit score. While not easy to achieve, it is possible to have an 800 credit score in Canada. - What can an 800 credit score get you in Canada?

With an 800 credit score in Canada, you are likely to get approved for lower interest credit cards and better rewards. It also improves your chances of getting a mortgage or car loan, as higher credit scores demonstrate financial responsibility.

How accurate is Credit Karma Canada

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Cached

Which country uses Credit Karma

Credit Karma provides free credit scores and credit reports in the United States, Canada and United Kingdom from national credit bureaus TransUnion and Equifax, alongside daily credit monitoring from TransUnion.

CachedSimilar

How do I get my FICO score Canada

You can access your credit score online from Canada's 2 main credit bureaus. Your credit score from Equifax is accessible online for free and is updated monthly. If you live in Quebec, you can also access your credit score from TransUnion online for free.

What is similar to Credit Karma Canada

Borrowell, Mogo, and Credit Karma are free credit score sites that give Canadians access to their credit scores and reports at no charge. In addition to these two services, they also offer other financial products, including personal loans, credit cards, credit monitoring, identity protection, mortgages, and more.

What is a good credit score in Canada

between 660 to 724

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it's likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

Is my credit score valid in Canada

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information isn't shared across borders.

Are credit scores the same in U.S. and Canada

In Canada, your credit score will range from 300-900, while in America, scores usually range from 300-850. Although they function in very much the same way, in that you're looking for a high score.

Can I use my Credit Karma anywhere

You can use your Credit Karma Visa® Debit Card anywhere in the world where Visa is accepted. If you are unable to complete a transaction using your PIN, ask the merchant to process your payment as a Visa card.

What is FICO called in Canada

'hard' credit check. The score that most Canadian lenders use is called a FICO score, previously known as the Beacon score.

How hard is it to get a 800 credit score in Canada

However, statistics show that roughly 1 out of every seven Canadians have an 800 credit score, which is about 17% of people. In essence, an 800 credit score is not so easy to come by.

What can a 800 credit score get you in Canada

Benefits of a 800 Credit Score

This is because higher credit scores help to prove how financially responsible you are. With a score of 800 you are also likely to get approved for lower interest credit cards and better rewards. A high credit score also helps you get a mortgage or car loan.

Does US credit score matter in Canada

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information isn't shared across borders.

Does Canada and US use the same credit score

Canada's credit scoring is similar to the U.S. system. For instance: Scores are on a common range (in this case from 300 to 900), and higher is better. The two major credit reporting bureaus are TransUnion Canada and Equifax Canada.

Does Canadian credit count in USA

Unfortunately, your Canadian credit history cannot follow you to the United States. While credit reporting companies like Experian have operations in multiple countries, the information they maintain in each individual nation cannot be transferred across national boundaries for several reasons.

Can an American get credit in Canada

Canadian credit cards are available to non-residents and newcomers alike. Even without a credit history in the country, you can sign up for a variety of different cards, including store cards, prepaid cards, and secured credit cards.

What is the maximum withdrawal from Credit Karma

You may not exceed $10,000.00 in daily transaction activity nor $50,000.00 in monthly transaction activity.

Why can’t I access Credit Karma

You'll need to verify your identity by entering some personal information in order to regain access to your Credit Karma account. If you believe someone may have used your personal information to create a Credit Karma account without your permission, please follow the instructions below.

Is Canadian credit score same as us

In Canada, your credit score will range from 300-900, while in America, scores usually range from 300-850. Although they function in very much the same way, in that you're looking for a high score.

Is credit score a thing in Canada

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time. It can be an important part of building your financial confidence and security.

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

Can you actually get a 900 credit score Canada

In Canada, your credit score ranges from 300 to 900, 900 being a perfect score. If you have a score between 780 and 900, that's excellent. If your score is between 700 and 780, that's considered a strong score and you shouldn't have too much trouble getting approved with a great rate.

Does US debt follow you to Canada

Your US credit history does not in fact transfer to Canada, or reflect for Canadian credit bureaus when you move. Both countries have their own systems for credit reporting, each with its own rules. This means that credit information is not shared across the border.

Can I move to Canada with bad credit

Credit scores have little to no impact on the immigration process. That's because your credit score from your home country—good or bad—won't carry over to Canada. Establishing a strong credit history is nevertheless important once you arrive in Canada.

Do US and Canada share credit score

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information isn't shared across borders.

Does Canada and US have same credit score

Canada's credit scoring is similar to the U.S. system. For instance: Scores are on a common range (in this case from 300 to 900), and higher is better. The two major credit reporting bureaus are TransUnion Canada and Equifax Canada.

0 Comments