How do I report identity theft to credit bureau?

Summary of the Article

Should I contact the credit bureau about identity theft? Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation. Request these companies to place a fraud alert in your file as well as a credit freeze.

Do I need to report identity theft to all three credit bureaus? You must contact each credit reporting company individually if you would like to place a security freeze with all three nationwide credit reporting companies.

Does reporting identity theft hurt your credit score? Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name — and fail to pay the bills.

How do I check to see if someone is using my Social Security number for free? Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

What steps should you take if you become a victim of identity theft? Steps for Victims of Identity Theft or Fraud: Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

How do I freeze my Social Security number? This is done by calling our National 800 number (Toll-Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

What is step one if someone steals your identity? Contact your police department, report the crime, and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What to do if your SSN is stolen? You can contact the OIG’s fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov.

What are 3 steps you should take if you believe your identity has been compromised? Contact your police department, report the crime, and obtain a police report. Decide whether you want to place a security freeze on your credit report.

How long does it take to fix credit after identity theft? “It can take days, months, or even years to untangle identity theft,” says Tolmachoff. This is because each case of identity theft is unique, and the recovery timeline can depend on many factors, including the type of identity theft that took place.

How do I know if my Social Security number has been compromised? Check Your Credit Report. If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear. Look for accounts you don’t recognize or credit applications you never submitted.

Questions:

1. Should I contact the credit bureau about identity theft?

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation. Request these companies to place a fraud alert in your file as well as a credit freeze.

2. Do I need to report identity theft to all three credit bureaus?

You must contact each credit reporting company individually if you would like to place a security freeze with all three nationwide credit reporting companies.

3. Does reporting identity theft hurt your credit score?

Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name – and fail to pay the bills.

4. How do I check to see if someone is using my Social Security number for free?

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

5. What steps should you take if you become a victim of identity theft?

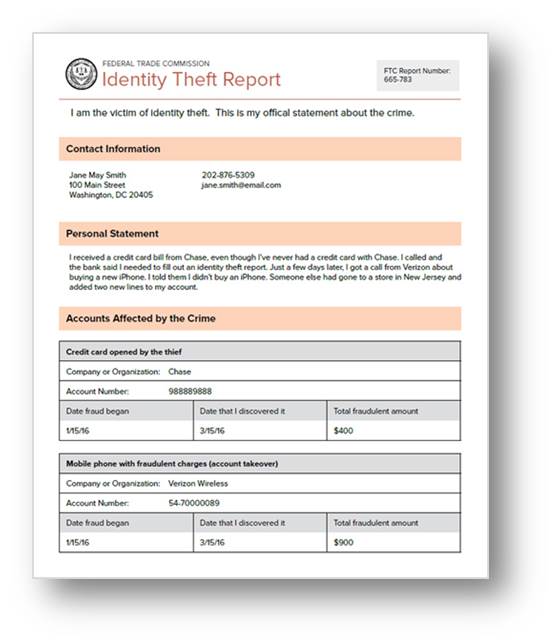

Steps for Victims of Identity Theft or Fraud: Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

6. How do I freeze my Social Security number?

This is done by calling our National 800 number (Toll-Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

7. What is step one if someone steals your identity?

Contact your police department, report the crime, and obtain a police report. Decide whether you want to place a security freeze on your credit report.

8. What to do if your SSN is stolen?

You can contact the OIG’s fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov.

9. What are 3 steps you should take if you believe your identity has been compromised?

Contact your police department, report the crime, and obtain a police report. Decide whether you want to place a security freeze on your credit report.

10. How long does it take to fix credit after identity theft?

“It can take days, months, or even years to untangle identity theft,” says Tolmachoff. This is because each case of identity theft is unique, and the recovery timeline can depend on many factors, including the type of identity theft that took place.

11. How do I know if my Social Security number has been compromised?

Check Your Credit Report. If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear. Look for accounts you don’t recognize or credit applications you never submitted.

Should I contact the credit bureau about identity theft

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation. – Request these companies to place a fraud alert in your file as well as a credit freeze.

Cached

Do I need to report identity theft to all three credit bureaus

You must contact each credit reporting company individually if you would like to place a security freeze with all three nationwide credit reporting companies.

Cached

Does reporting identity theft hurt your credit score

Could it hurt my credit scores Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name — and fail to pay the bills.

Cached

How do I check to see if someone is using my Social Security number for free

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

What steps should you take if you become a victim of identity theft

Steps for Victims of Identity Theft or FraudPlace a fraud alert on your credit report.Close out accounts that have been tampered with or opened fraudulently.Report the identity theft to the Federal Trade Commission.File a report with your local police department.

How do I freeze my Social Security number

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

What is step one if someone steals your identity

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What to do if your SSN is stolen

You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at oig.ssa.gov.

What are 3 steps you should take if you believe your identity has been compromised

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

How long does it take to fix credit after identity theft

"It can take days, months, or even years to untangle identity theft," says Tolmachoff. This is because each case of identity theft is unique, and the recovery timeline can depend on many factors, including the type of identity theft that took place.

How do I know if my Social Security number has been compromised

Check Your Credit Report.

If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear. Look for accounts you don't recognize or credit applications you never submitted.

How do you check if my identity is being used

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

Are you responsible for the debt if someone stole your identity

In most states, you're not liable for any debt that occurred as a result of fraudulent accounts being opened. Plus, under federal law, you are only liable for the first $50 in fraudulent charges on your credit card if someone uses your card to make a purchase.

How do I find out if someone took a loan in my name

To find out who opened a loan in your name, check your credit report, which will list the account and lender. Then file a dispute with all the major credit bureaus (Experian, Equifax, and TransUnion) to remove the entry from your report.

How do I freeze my credit if my SSN is stolen

There are measures you can take to help prevent further unauthorized use of your SSN and other personal information. You can lock your SSN by calling the Social Security Administration or by creating an E-Verify account. Also, you can contact all three of the nationwide CRAs to place a freeze on your credit reports.

What happens if someone steals your Social Security number

A dishonest person who has your Social Security number can use it to get other personal information about you. Identity thieves can use your number and your good credit to apply for more credit in your name. Then, when they use the credit cards and don't pay the bills, it damages your credit.

What three things should you do if your identity is stolen

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What 4 things you do if you are a victim of identity theft

How to report ID theftThe Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338.The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.The fraud department at your credit card issuers, bank, and other places where you have accounts.

How do you put an alert on your Social Security number

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

Can I check to see if my SSN has been compromised

Check Your Credit Report.

If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear.

What should I do if I am a victim of identity theft

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

How can I find out if someone is using my identity

You should review your bank account statements regularly; if you see unknown purchases, that could be a sign that your identity has been stolen. Check credit reports. Similarly, monitor your credit reports from all three credit-reporting bureaus for any unknown accounts or inaccurate information.

What to do immediately after identity theft

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts. The fraud department at your credit card issuers, bank, and other places where you have accounts.

How can you check to see if your identity has been stolen

Warning signs of ID theftBills for items you did not buy.Debt collection calls for accounts you did not open.Information on your credit report for accounts you did not open.Denials for loan applications.Mail stops coming to – or is missing from – your mailbox.

How do you check if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

0 Comments