Can you use Credit Karma in Canada?

Can I use my Credit Karma card anywhere?

You can use your Credit Karma Visa® Debit Card anywhere in the world where Visa is accepted. If you are unable to complete a transaction using your PIN, ask the merchant to process your payment as a Visa card.

Is Credit Karma accurate in Canada?

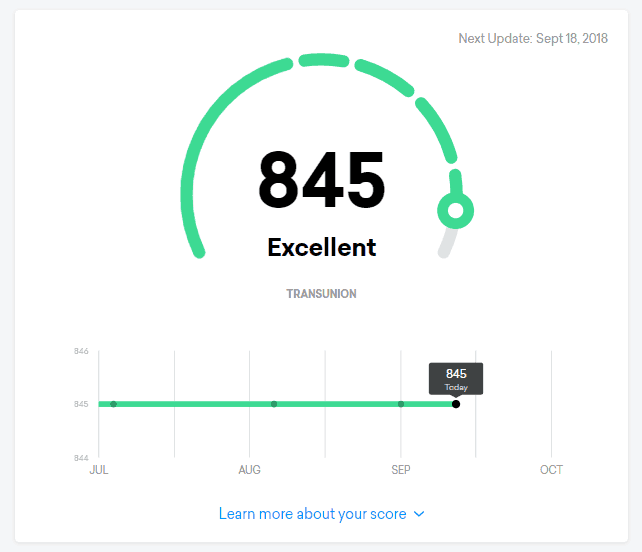

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Does Credit Karma use Equifax in Canada?

In Canada, there are two other companies in addition to Credit Karma that provide people with free information about their credit: Borrowell and Mogo. Borrowell, Mogo, and Credit Karma provide the same service, however, Borrowell and Mogo pull from Equifax whereas Credit Karma pulls from TransUnion.

Does Credit Karma affect credit score in Canada?

Sign up with confidence. Checking your credit on Credit Karma won’t hurt your score.

Does Credit Karma debit card charge foreign transaction fees?

If you use your card to transact in foreign currencies, you’ll be charged a 1% fee of the total purchase by Visa for each transaction. This Visa International Card Fee is charged by Visa and not by Credit Karma. How does Credit Karma Money™ Spend work Credit Karma is not a bank.

What ATM can I use my Credit Karma card at?

You can use your Credit Karma Visa® Debit Card to withdraw cash at any ATM that supports Visa. Fees may apply for ATM transactions outside of the Allpoint network.

Can I use my credit score in Canada?

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information isn’t shared across borders.

Is 650 a good credit score in Canada?

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it’s likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

Is the credit score different in Canada and the US?

In Canada, your credit score will range from 300-900, while in America, scores usually range from 300-850. Although they function in very much the same way, in that you’re looking for a high score.

Can I transfer my credit score to Canada?

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information isn’t shared across borders.

Is 700 a bad credit score in Canada?

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it’s likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

Can I use my Credit Karma card anywhere

You can use your Credit Karma Visa® Debit Card anywhere in the world where Visa is accepted. If you are unable to complete a transaction using your PIN, ask the merchant to process your payment as a Visa card.

Is Credit Karma accurate Canada

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

Cached

Does Credit Karma use Equifax in Canada

In Canada, there are two other companies in addition to Credit Karma that provide people with free information about their credit: Borrowell and Mogo. Borrowell, Mogo and Credit Karma provide the same service, however, Borrowell and Mogo pull from Equifax whereas Credit Karma pulls from TransUnion.

Does Credit Karma affect credit score in Canada

Sign up with confidence. Checking your credit on Credit Karma won't hurt your score.

Does Credit Karma debit card charge foreign transaction fees

If you use your card to transact in foreign currencies, you'll be charged a 1% fee of the total purchase by Visa for each transaction. This Visa International Card Fee is charged by Visa and not by Credit Karma. How does Credit Karma Money™ Spend work Credit Karma is not a bank.

What ATM can I use my Credit Karma card at

You can use your Credit Karma Visa® Debit Card to withdraw cash at any ATM that supports Visa. Fees may apply for ATM transactions outside of the Allpoint network.

Can I use my credit score in Canada

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information isn't shared across borders.

Is 650 a good credit score in Canada

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it's likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

Is credit score different in Canada and US

In Canada, your credit score will range from 300-900, while in America, scores usually range from 300-850. Although they function in very much the same way, in that you're looking for a high score.

Can I transfer my credit score to Canada

Unfortunately, your U.S. credit history will not transfer to Canadian credit reporting companies when you move. Each country has its own unique credit reporting system with different laws regulating them, so the information isn't shared across borders.

Is 700 a bad credit score Canada

In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it's likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score. The credit score range is anywhere between 300 to 900.

Can I use my debit card in Canada

Canadian merchants accept Visa, Mastercard and American Express credit cards. Canada uses Interac Direct Payment (IDP) and you can use this system to get cash out over-the-counter if you're paying with your debit or travel card.

How do I avoid international fees on my debit card

These fees can be avoided by choosing a bank account that doesn't charge fees and reimburses out-of-network ATM fees and by always withdrawing local currency from ATMs. Account holders can also ask their home bank if there are partner branches or in-network ATMs in the destination country or countries.

Does Credit Karma charge for ATM withdrawals

If you use an ATM outside of the Allpoint network, we still don't charge you a fee but the owner of the ATM may charge a fee for using their ATM. This fee is not charged by Credit Karma. For any international debit transaction, Visa charges a 1% currency conversion fee.

How much can I withdraw from my Credit Karma card from ATM

You may not exceed $10,000.00 in daily transaction activity nor $50,000.00 in monthly transaction activity.

Can Americans get credit in Canada

Canadian credit cards are available to non-residents and newcomers alike. Even without a credit history in the country, you can sign up for a variety of different cards, including store cards, prepaid cards, and secured credit cards.

Does Canada and US use the same credit score

Canada's credit scoring is similar to the U.S. system. For instance: Scores are on a common range (in this case from 300 to 900), and higher is better. The two major credit reporting bureaus are TransUnion Canada and Equifax Canada.

How hard is it to get a 800 credit score in Canada

However, statistics show that roughly 1 out of every seven Canadians have an 800 credit score, which is about 17% of people. In essence, an 800 credit score is not so easy to come by.

How to get 900 credit score Canada

How to Get a Perfect Credit ScoreNever Miss a Payment. Since payment history accounts for 35% of your credit score, it's important to pay all your bills on time.Keep Your Credit Utilization Rate Low.Don't Apply for Credit Too Often.Review Your Credit Reports.Become an Authorized User.

Can an American get credit in Canada

Canadian credit cards are available to non-residents and newcomers alike. Even without a credit history in the country, you can sign up for a variety of different cards, including store cards, prepaid cards, and secured credit cards.

Does Canada accept U.S. credit

Canadian merchants accept Visa, Mastercard and American Express credit cards. Canada uses Interac Direct Payment (IDP) and you can use this system to get cash out over-the-counter if you're paying with your debit or travel card.

Does Canada accept US credit

Canadian merchants accept Visa, Mastercard and American Express credit cards. Canada uses Interac Direct Payment (IDP) and you can use this system to get cash out over-the-counter if you're paying with your debit or travel card.

Can I use USA debit card in Canada

Yes. Cards issued by U.S. Bank can be used in most foreign countries for transactions.

Can I use my US card in Canada

Yes, you can use your credit card in Canada, but you'll have better luck with some types of cards than others. Visa and Mastercard are the most widely accepted networks, and you should be able to use their cards at any merchants that take credit cards in Canada.

What debit card doesn t charge international fees

Citibank Citi Priority Checking Account

Travel perks including no Citibank fees on ATM withdrawals worldwide and no foreign exchange fees when using debit card abroad. Choose from more than 65,000 fee-free ATMs at Citibank branches and participating retail locations nationwide.

0 Comments