Who gives CIBIL?

Summary of the article:

CIBIL India is part of TransUnion, an American multinational group. Hence credit scores are known in India as the CIBIL Transunion score.

CIBIL TransUnion Score is made available to individual consumers. TransUnion acquired a 92.1% stake in CIBIL.

Credit Institutions (banks, RRBs, co-operative bank, NBFC, public financial institution, housing finance institution, etc.; companies engaged in the business of credit cards and other similar cards; and companies dealing with the distribution of credit in any other manner or any other institution which the Reserve Bank may…) can report to CIBIL.

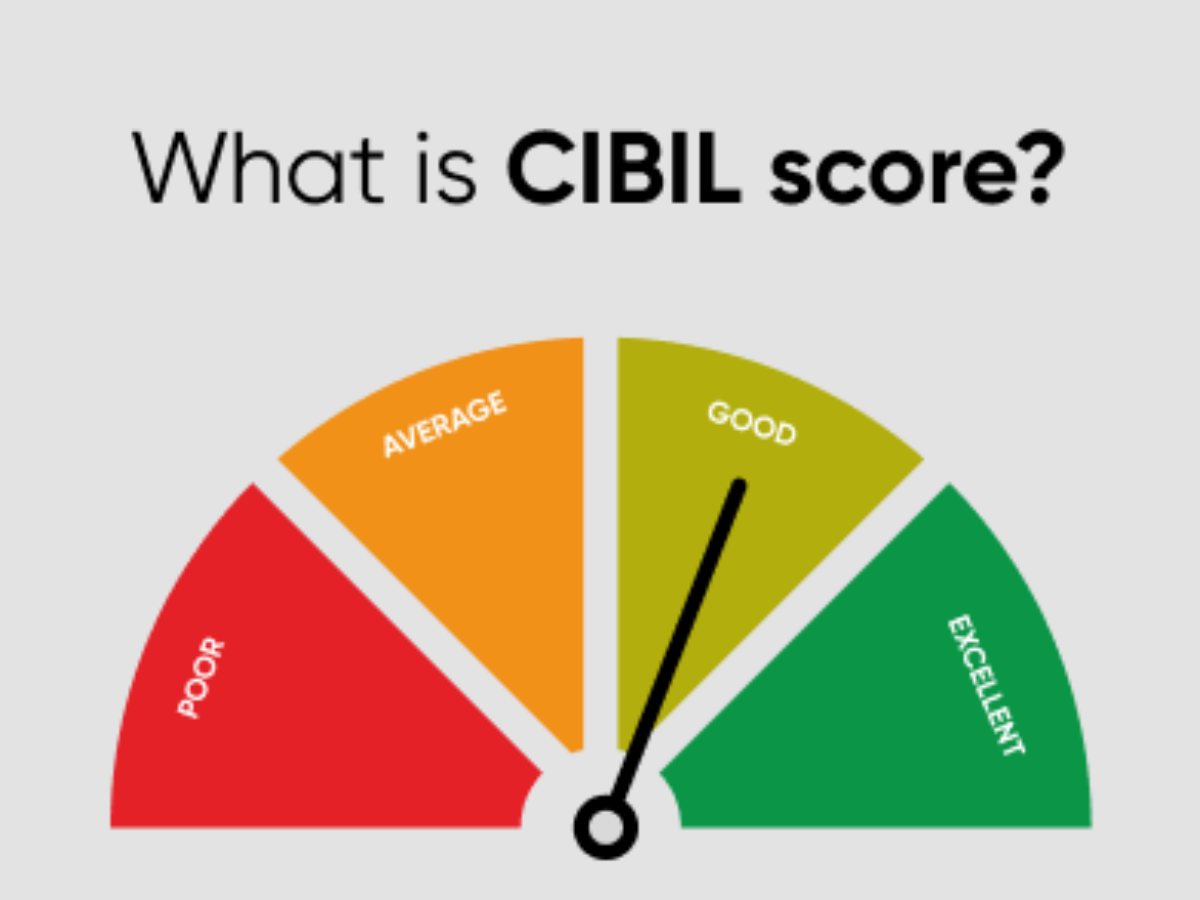

There is no specific mathematical formula to calculate credit score and it varies from bureau to bureau. Credit score, also commonly known as CIBIL score, is calculated based on your credit history and is considered as the most important component of your credit report.

Both CIBIL and Experian have their own plus points. However, in India, the CIBIL business credit score has the edge over the Experian one because nearly 90% of Indian banks and financial institutions have tied with CIBIL.

Every month, various banks and NBFC’s furnish their reports to check CIBIL score for multiple individuals and businesses. This, in turn, assists them to choose the appropriate customers and monitor the repayment patterns of existing customers.

Most lending institutions require the CIBIL score for evaluating the candidate’s application. Though the Experian score is accurate and does determine the individual’s loan repayment capacity, it is not very commonly mandated. This comes under the Reserve Bank Of India.

CIBIL offers a detailed credit report. Equifax also offers a detailed report but it also provides a pictorial representation of the credit report which is easier to understand. CIBIL has a larger network of clients and partner banks and financial institutions when compared to Equifax.

Following its acquisition by TransUnion, a leading provider of credit and identity-management services, CIBIL is now known as TransUnion CIBIL. Before extending credit to borrowers, lenders evaluate the borrower’s creditworthiness using the credit information maintained by CIBIL.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will usually give you access to the best rates on credit cards, auto loans, and any other loans.

A good credit history can be maintained by following these 6 simple rules: Rule 1: Always pay your EMIs/Dues on time. Late payments are viewed negatively by lenders and may affect the chances of your loan getting approved. Rule 2: Keep your balances low.

Questions:

1. Who is responsible for CIBIL?

CIBIL India is part of TransUnion, an American multinational group.

2. Is CIBIL part of TransUnion?

Yes, TransUnion acquired a 92.1% stake in CIBIL.

3. Who can report to CIBIL?

Credit Institutions can report to CIBIL.

4. How is CIBIL determined?

CIBIL score is calculated based on credit history and varies from bureau to bureau.

5. What is the difference between Experian and CIBIL?

CIBIL has a larger network of clients and partner banks and financial institutions in India.

6. Can banks provide CIBIL score?

Yes, banks and NBFC’s furnish reports to check CIBIL scores for individuals and businesses.

7. Do banks check CIBIL or Experian?

Most lending institutions require CIBIL scores, while Experian scores are not commonly mandated.

8. Is CIBIL and Equifax different?

CIBIL offers a detailed credit report, while Equifax provides a pictorial representation of the credit report.

9. What is the difference between CIBIL and TransUnion?

CIBIL is now known as TransUnion CIBIL after its acquisition by TransUnion.

10. What is the highest CIBIL score?

A perfect score is 850, but any score of 800 or up is considered exceptional.

11. How is CIBIL score maintained?

Good credit history can be maintained by paying EMIs/dues on time and keeping balances low.

Who is responsible for CIBIL

CIBIL India is part of TransUnion, an American multinational group. Hence credit scores are known in India as the CIBIL Transunion score.

Is CIBIL part of TransUnion

CIBIL TransUnion Score is made available to individual consumers. TransUnion acquired a 92.1% stake in CIBIL.

Who can report to CIBIL

Credit Institutions (banks, RRBs, co-operative bank , NBFC, public financial institution, housing finance institution etc.; companies engaged in the business of credit cards and other similar cards; and companies dealing with distribution of credit in any other manner or any other institution which the Reserve Bank may …

How is CIBIL determined

There is no specific mathematical formula to calculate credit score and it varies from bureau to bureau. Credit score, also commonly known as CIBIL score is calculated on the basis of your credit history and is considered as the most important component of your credit report.

What is the difference between Experian and CIBIL

Both CIBIL and Experian have their own plus points. However, in India, the CIBIL business credit score has the edge over the Experian one because nearly 90% of Indian banks and financial institutions have tied with CIBIL.

Can banks provide CIBIL score

Every month, various banks and NBFC's furnish their reports to check CIBIL score for multiple individuals and businesses. This, in turn, assists them to choose the appropriate customers and monitor the repayment patterns of existing customers.

Do banks check CIBIL or Experian

Most lending institutions require the CIBIL score for evaluating the candidate's application. Though the Experian score is accurate and does determine the individual's loan repayment capacity, it is not very commonly mandated. This comes under the Reserve Bank Of India.

Is CIBIL and Equifax different

CIBIL offers a detailed credit report. Equifax also offers a detailed report but it also provides a pictorial representation of the credit report which is easier to understand. CIBIL has a larger network of clients and partner banks and financial institutions when compared to Equifax.

What is the difference between CIBIL and TransUnion

Following its acquisition by TransUnion, a leading provider of credit and identity-management services, CIBIL is now known as TransUnion CIBIL. Before extending credit to borrowers, lenders evaluate the borrower's creditworthiness using the credit information maintained by CIBIL.

What is the highest CIBIL score

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will usually give you access to the best rates on credit cards, auto loans, and any other loans.

How is CIBIL score maintained

A good credit history can be maintained by following these 6 simple rules: Rule 1: Always pay your EMIs/Dues on time. Late payments are viewed negatively by lenders and may affect the chances of your loan getting approved. Rule 2: Keep your balances low.

Which is more accurate CIBIL or Experian

Both CIBIL and Experian have their own plus points. However, in India, the CIBIL business credit score has the edge over the Experian one because nearly 90% of Indian banks and financial institutions have tied with CIBIL.

Will my bank give me my credit score

Many credit card companies, banks and loan companies have started providing credit scores for their customers. It may be on your statement, or you can access it online by logging into your account.

Do banks look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Why is Experian score higher than CIBIL

Advantages and Disadvantages of Experian & CIBIL

Both CIBIL and Experian have their own plus points. However, in India, the CIBIL business credit score has the edge over the Experian one because nearly 90% of Indian banks and financial institutions have tied with CIBIL.

Which is more accurate CIBIL or Equifax

Validity of the scores from the different credit bureaus :

The credit scores issued by all the bureaus are equally valid though some lenders might have their own preferences. However, the credit scores issue by Equifax and CIBIL™ and the other two companies all have the same validity.

Which is better Experian or CIBIL

Both CIBIL and Experian have their own plus points. However, in India, the CIBIL business credit score has the edge over the Experian one because nearly 90% of Indian banks and financial institutions have tied with CIBIL.

Which is more important CIBIL or Equifax

Validity of the scores from the different credit bureaus :

The credit scores issued by all the bureaus are equally valid though some lenders might have their own preferences. However, the credit scores issue by Equifax and CIBIL™ and the other two companies all have the same validity.

Does anyone have 800 CIBIL score

A credit score of 800 means you have an exceptional credit score, according to Experian. According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Can I rebuild my CIBIL score

Pay your credit card bills and EMIs on time. Paying monthly dues on time will improve your credit report. 'Settled' to 'Closed': You can upgrade your credit score by changing your account status to 'Closed' from 'Settled'. In order to do that, you will have to pay off all your debt.

Who maintains CIBIL score in India

TransUnion CIBIL Limited

TransUnion CIBIL Limited is a credit information company operating in India. It maintains credit files on 600 million individuals and 32 million businesses. TransUnion is one of four credit bureaus operating in India and is part of TransUnion, an American multinational group.

Do banks use CIBIL or Experian

The two organisations have distinct algorithms to calculate and maintain a credit score. However, CIBIL is widely considered for its business credit scores. Thus, most leading banks and financial institutions continue to consult with CIBIL for their requirements.

How accurate is Credit Karma

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Do banks offer free credit score

You can get a free credit report from each of the three big credit agencies: Equifax, Experian, and TransUnion. With the exception of Experian, you will be charged a fee if you want to see your actual credit score. The good news is that you may be able to get your score for free from a bank or credit card issuer.

Do banks check cibil or Experian

Most lending institutions require the CIBIL score for evaluating the candidate's application. Though the Experian score is accurate and does determine the individual's loan repayment capacity, it is not very commonly mandated. This comes under the Reserve Bank Of India.

0 Comments